Nike KD 14 Home White Black CW3935 100 Release Date | RvceShops - DB1550 - Nike Air Max 93 South Beach 'White Metallic Silver' - 100

Nike Air Max 93 'Flame Red' White/Habanero Red-Neutral Indigo-Black 306551-102 Release Date | Sole Collector

Nike Air Max 93 'Flame Red' White/Habanero Red-Neutral Indigo-Black 306551-102 Release Date | Sole Collector

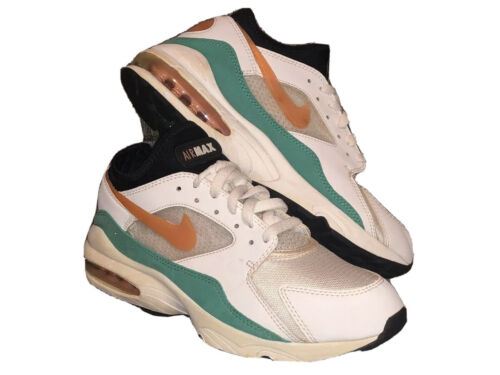

South Beach vibes #airmax93 #sneakers #kicks #sneakerhead #trainers #sneakertruth | Nike air max, New sneakers, Sneakers